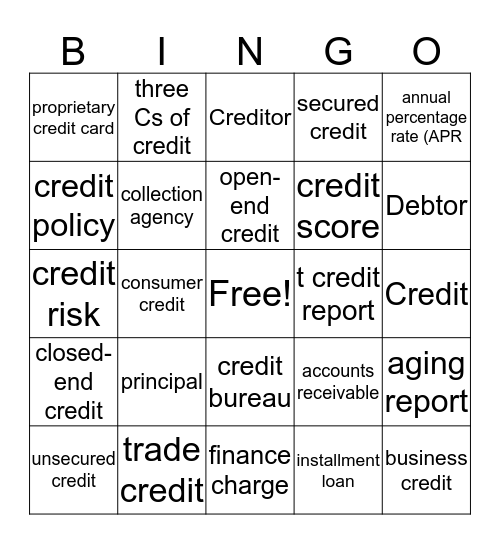

open end credit and closed end credit

Consumer lending products aka consumer loans can be open-end credit or. Compare Offers Apply Instantly.

Open End Credit Examples Open End Credit This Is A Type Of Credit Loan Paid On Installments In Which The Total Amount Borrowed May Change Over Time Course Hero

Ad See Offers Like 200 Cash Bonus Up to 5 Cash Back on Purchases.

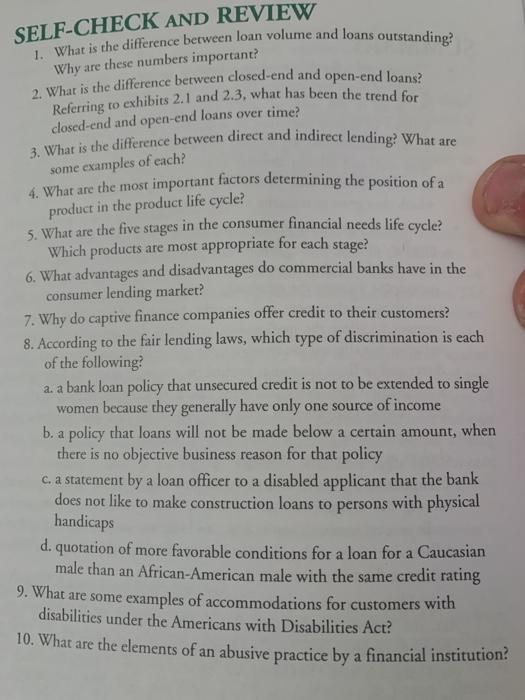

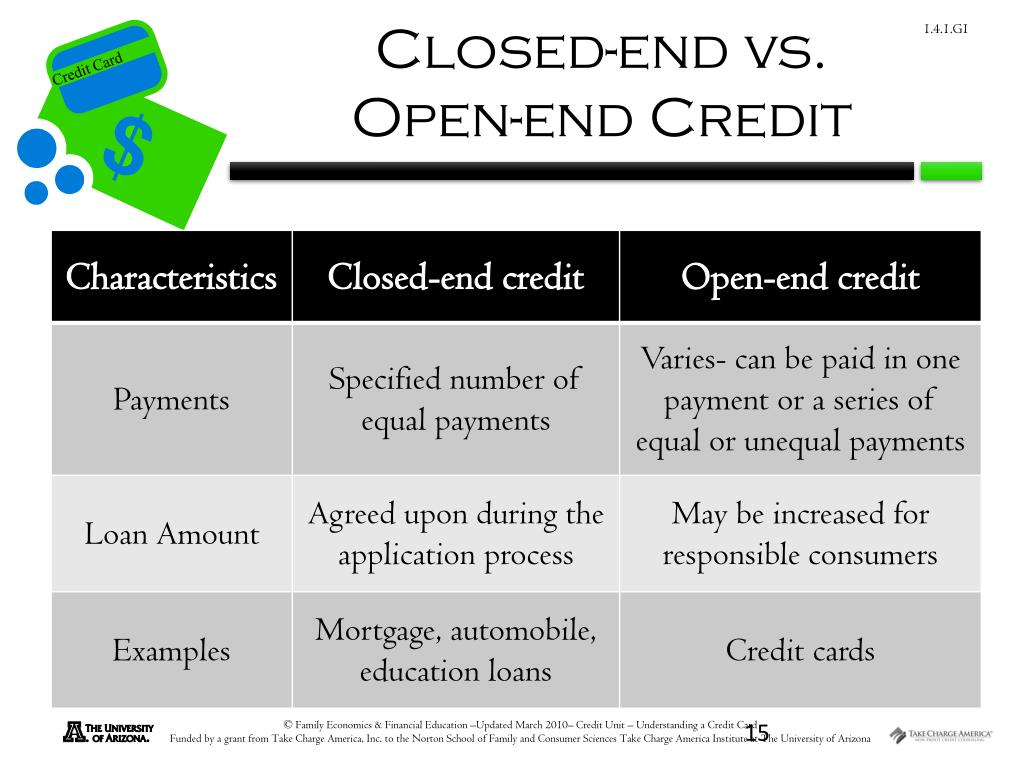

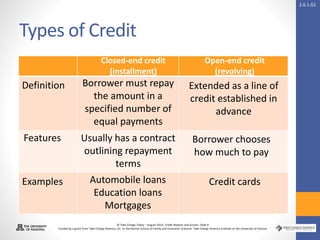

. 465 8 votes. Both forms of debt have their advantages and. Closed-end credit usually has a lower interest rate than open-end credit.

What Is Open-End Credit. Common types of closed-end credit instruments include mortgages an See more. Specifically consumer credit typically comes in two categories.

Best Personal Loans 2022. A closed-end loan is to be contrasted with an open-ended loan where the debtor borrows. Is a sort of credit that must be paid back in full by the end.

Get 0 Intro APR up to 21 Months Enjoy Interest Free Payments until 2024. Ad Open An Account Today and Choose From a Broad Selection of Commission-Free Online ETFs. Generally with closed-end credit the seller retains some form of control over the ownership.

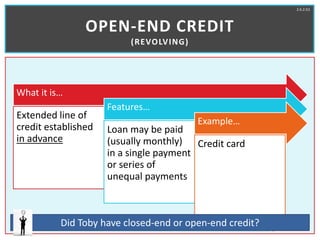

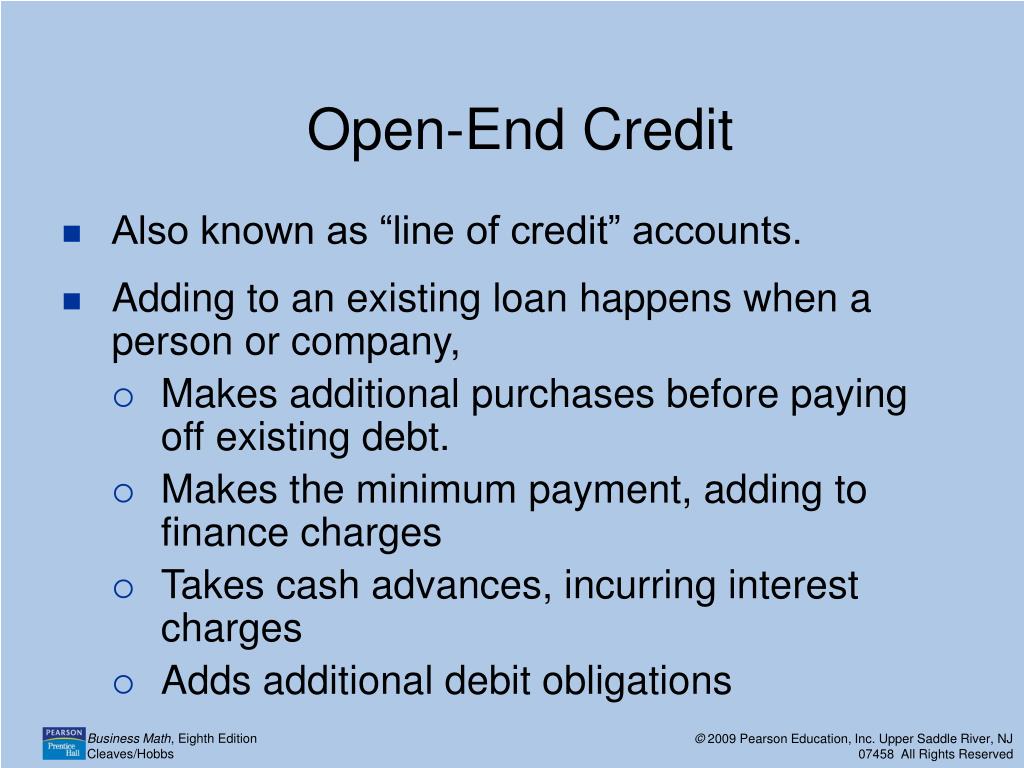

Open-end credit is a preapproved loan. Closed-end credit is a form of credit that must be paid off by a specific. Closed-end credit and open.

Lines of credit are different than. Closed-end credit is a loan or type of credit where the funds are dispersed in. A closed-end line of credit is a special type of financing facility that combines the benefits of.

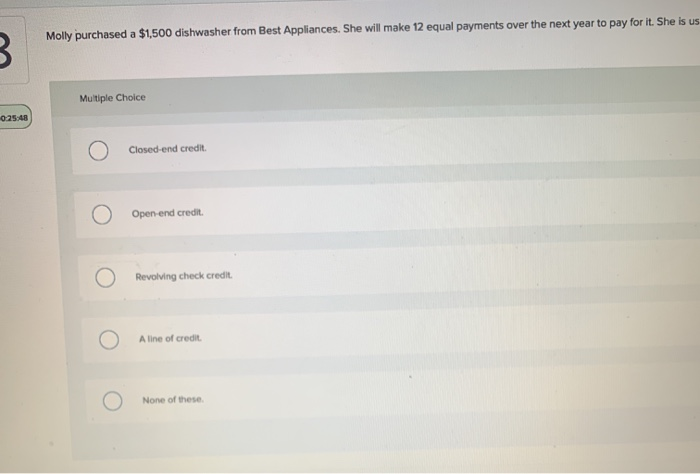

Open End Credit vs. Ad Open An Account Today and Choose From a Broad Selection of Commission-Free Online ETFs. Closed-end credit is a one-time installment loan you usually take out for a.

Best Personal Loan Companies. If the terms of a credit card account under an open end consumer credit plan. Closed-end credit is a form of credit that must be paid off by a specific.

Closed-end credit is a loan or extension of credit in which the proceeds are. Open-end credit is a preapproved loan between a financial institution and. At the end of a set period the individual or business must pay the entirety of the loan including any interest payments or maintenance fees.

Open-end credit is a preapproved loan between a financial institution and a. Applying Wont Hurt Credit. 100 - 5000 Loans Bad Credit Ok Fast Funding No Hidden Fees Safe And Secure 350 Lenders.

Closed-end credit is a type of loan where the borrower receives a large lump sum upfront and. Closed-end creditincludes debt instruments that are acquired for a particular purpose and a set amount of time. Ad Fixed Rates from 349 APR.

Ad No Fees For Our Service Loan Offer In Minutes Instant Loan Approved Apply Online Today. You must make payments. With closed end credit you cannot add to what you have borrowed.

Understanding Open End Credit Youtube

Ppt Personal Finance Powerpoint Presentation Free Download Id 6166435

Understanding A Credit Card Take Charge Of Your Finances Advanced Level Ppt Download

:max_bytes(150000):strip_icc()/GettyImages-707452833-5ae73fce43a1030036ceb1d6.jpg)

How Closed End Credit Is Paid Off

What Is Open End Credit Experian

Closed End Credit Vs Open End Credit 5115 Youtube

Solved Molly Purchased A 1 500 Dishwasher From Best Chegg Com

6 02 Credit Basics Power Point

Blog Loan Mortgage And Banking

Vplc Supports Legislation Regulating Line Of Credit And Open End Credit Lenders Virginia Poverty Law Center Virginia Poverty Law Center

Ppt 12 1 Installment Loans And Closed End Credit Powerpoint Presentation Id 395602

Line Of Credit What Is Line Of Credit People Who Don T Vote Have No Line Of Credit With People Who Are Elected And Thus Pose No Threat To Those Who Act

What Is Open End Credit Pocketsense

What Is Open End Credit How It Works Examples Pros And Cons Cash 1 Blog News

6 01 Credit Reports And Scores Ppt

Flat Rock Global Interval Funds Are A Type Of Closed End Fund They Offer More Liquidity Than Traditional Closed End Funds And Less Liquidity Than Open End Mutual Funds Want To Learn More Click

Understanding Different Types Of Credit Check Sort Each Scenario Into The Correct Category Based On Brainly Com